TFCU is prepared to assist members during a government shutdown.

In response to the partial government shutdown, Tinker Federal Credit Union is prepared to assist our affected members.

![]() Notice: All TFCU branches will be closed on Monday, February 16, in observance of the federal holiday. You can still access your accounts through online and mobile banking. For a full list of holiday closings, visit here.

Notice: All TFCU branches will be closed on Monday, February 16, in observance of the federal holiday. You can still access your accounts through online and mobile banking. For a full list of holiday closings, visit here.

Move your high-rate credit card balances to TFCU Visa Signature® and save. Check out our special intro rate and everyday rates.

Move your high-rate credit card balances to TFCU Visa Signature® and save. Check out our special intro rate and everyday rates.

Refi your high-rate loan from another financial institution and save today. See our special offers.

Refi your high-rate loan from another financial institution and save today. See our special offers.

Spring and storm season will be here before you know it. TFCU has you covered with storm shelter loan rates as low as 3.99%*

TFCU is prepared to assist members during a government shutdown

In response to the partial government shutdown, Tinker Federal Credit Union is prepared to assist our affected members.

Get the tax help you need and special member savings with TurboTax and H&R Block. Take advantage of special member discounts and expert tax help.

Jonathan Ortiz of Ponca City, Oklahoma is the big winner of the TFCU Great Auto Loan Payoff. He kept the news a secret from his wife all week, making the celebration even more meaningful for their family.

We’re excited to have launched the YOU + TFCU Podcast, rooted in community and made for TFCU members. We’re excited to bring you more open and honest conversations connecting financial topics to real life to strengthen our communities.

How about some extra cash in your pocket? Refinance your secured loan from another institution and we will pay you $200 cash or give you a 0.50% rate reduction.* Either way, TFCU is giving back to you.

Looking for a dependable vehicle? Check out our repossessed vehicles lot and get great deals. Located behind the Midwest City branch, TFCU’s vehicle sales lot offers you great prices and special rates on used cars, trucks and motorcycles.

There is a scam circulating regarding funds being withdrawn from TFCU accounts. We encourage you to be aware of potential text scams and to protect yourself from fraudsters pretending to be TFCU.

TFCU offers workshops for adults, students and kids to help provide them with the tools they need to manage their money and improve their quality of life.

Check out our newest articles below or explore more articles.

In response to the partial government shutdown, Tinker Federal Credit Union is prepared to assist our affected members.

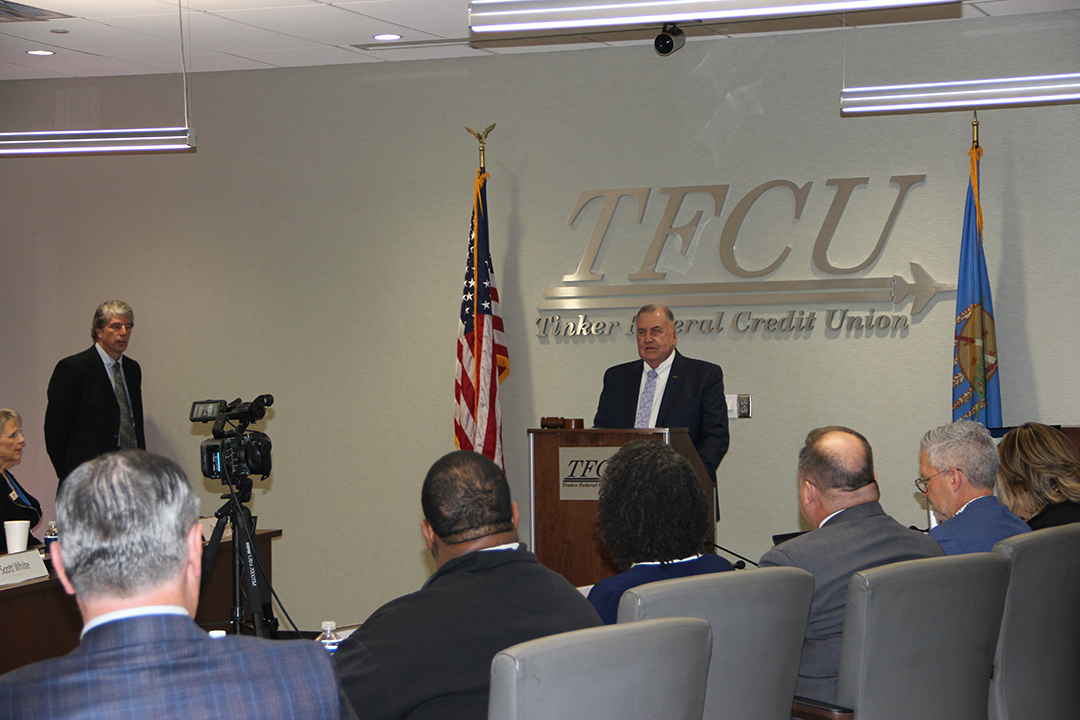

Tinker Federal Credit Union’s 2026 annual shareholders’ meeting will be held at 5 p.m. on Tuesday, March 31, 2026. A livestream link will be available at TinkerFCU.org on the day of the meeting.

Beginning in 2025, a new federal tax deduction allows eligible consumers to reduce their taxable income by deducting interest paid on qualifying auto loans, up to $10,000 per year. This deduction applies to tax years 2025 through 2028 and is

The nominating and elections committee has nominated two candidates this year to serve on TFCU’s board of directors. James Pearl and Eldon Overstreet have both been nominated for reelection. TFCU members who were not nominated by the committee, but would

Since 1946, TFCU has been a safe and secure place for your money. In community, in life and in money. You + TFCU.

TFCU has given back to members this year just for using their TFCU accounts and services.

Become a member-owner of one of the nation’s largest cooperative financial institutions. There are over 3,600 ways to qualify!

Let the TFCU Financial Advisors help you create financial strategies for your long-term financial needs and more.