- Become a Member

- Locations

- Contact Us

- Search Our Site

- Routing #303085829

To help you find more information about a specific topic or issue, we have created the following frequently asked questions.

What’s changing with my online and mobile banking for my business?

TFCU has partnered with an industry-leading provider in online and mobile banking to enhance the platform for our financial services for businesses. These changes will take effect Monday, October 7. If you hold TFCU business accounts, you’ll need to download the new app named Tinker FCU Business in the Apple or Google Play app store. To log in for the first time, you’ll follow the steps below.

Your new desktop log in for online banking will be found at TinkerFCU.org. Click the drop-down menu in the main navigation and select “Business Login” to get started. Follow the steps above to confirm your identity and update your password.

Is the website changing?

Yes. On Monday, October 7, all TFCU business account information and your online banking login will be found at TinkerFCU.org.

Will my account numbers change?

Yes, when you log in to your online and mobile banking, you’ll be able to see your new business account number or you can visit a TFCU branch for assistance.

Will the routing number change?

Yes, the routing number associated with your accounts will change to 303085829.

Will I need to make changes to my ACH and draft transactions?

Yes, please use ABA routing number 303085829 instead of 103103266, and the new 13-digit MICR account number found in your new online and mobile banking. If you need assistance, please contact us at 405-340-2775.

Will I be able to conduct my in-person business at any TFCU branch?

You’ll be able to conduct your standard business account transactions like deposits and payments at any TFCU branch. At this time, commercial loan applications will still be handled at our Edmond North branch located at 1016 W Covell Road.

Will there be any changes to my account statements and notices?

Yes, you will start to receive separate statements for each of your TFCU business accounts. They will look a little different than before, but they will have all the information you need and you can opt in to receive check images.

Will there be changes to Bill Pay?

Yes, all payments scheduled before the downtime will process as scheduled. To make the update, Bill Pay will be unavailable September 30 through October 7.

Will my loan payment process change?

You will be able to conduct all of your loan payments and account transfers within the new business online and mobile banking platforms or in person at any TFCU branch.

Will I be able to use Positive Pay?

Yes, Positive Pay will be available in the new online and mobile banking. We will contact existing Positive Pay users in the fourth quarter of 2024 to assist with the transition.

Will my remote deposit machine change?

If you’re currently using a remote deposit scanner for your business, we’re excited to provide new software that offers a more user-friendly experience. We’ll be contacting you about your update between September 23 and October 11.

Do I need to order new checks?

If you’re currently using checks for your business, you will still be able to use your old checks. If you would like to order new checks, you can do so through your online and mobile banking, by calling the Member Service Center at 405-732-0324, or in person at any full-service TFCU branch.

Is my business debit card changing?

Yes, please expect to receive a new special-edition “Black Mesa” TFCU Business debit card in October 2024. You’ll be able to use your current debit card until you receive your new card.

For more details about the TFCU Business debit card, please visit: TinkerFCU.org/business/debit-card

Will I still be able to access my eStatements in online and mobile banking?

Yes, statements from the past seven years will be available in the new platform.

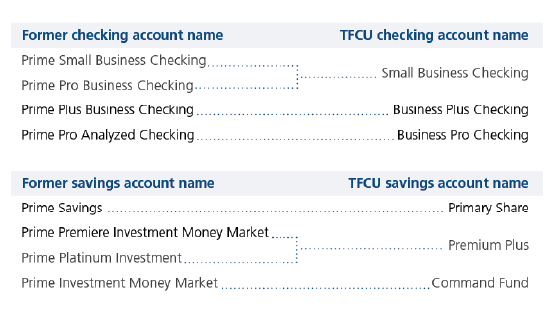

Will the names of my accounts change?

Yes, when you log in to your new online and mobile banking, you’ll see your new account names or you can visit a TFCU branch for assistance. The table below shows the former names of accounts and what they’ll be called moving forward as part of the TFCU system.

Details about your TFCU accounts listed above can be found at TinkerFCU.org, or contact our team at 405-340-2775 with any questions.

Will terms and conditions for my accounts and services change?

Yes. Please expect to receive updated terms and conditions by mail for your TFCU accounts in September 2024.

What’s changing with my online and mobile banking for my personal accounts?

For your personal accounts and services with TFCU, you’ll need to update to new online and mobile platforms. You can find the app named Tinker FCU in the Apple or Google Play app store and look for the icon seen at the right. To log in for the first time, you’ll follow the steps below.

Your new desktop login for online banking will be found at TinkerFCU.org. Click the drop-down menu in the main navigation and select “Personal Login” to get started. Follow the steps above to log in and update your password.

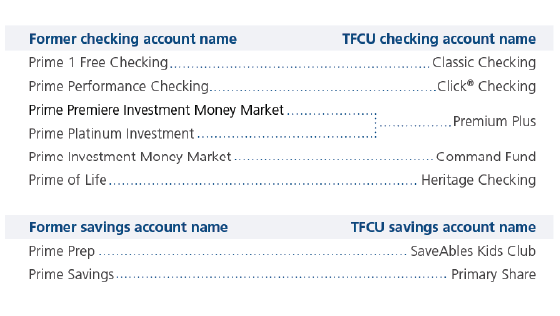

Are the names and numbers of my accounts changing?

Yes, when you log in to your new online and mobile banking, you’ll see your new account names or you can visit a TFCU branch for assistance. The table below shows the former names of accounts and what they’ll be called moving forward as part of the TFCU system.

Details about your TFCU accounts listed above can be found at TinkerFCU.org or contact our Member Service Center at 405-732-0324 with any questions.

Will terms and conditions for my accounts and services change?

Yes. Please expect to receive updated terms and conditions by mail for your TFCU accounts in September 2024.

Is my debit card changing?

Yes, please expect to receive a new TFCU MoneyPlus™ debit card in the fourth quarter of 2024. You’ll be able to use your current debit card until you receive your new card. The MoneyPlus debit card is contactless, convenient and digital-wallet compatible.

For more details about the MoneyPlus card, please scan the code or visit: TinkerFCU.org/money-plus-card

Is the website changing?

Yes. In the fourth quarter of 2024, your checking and savings account information and your online banking login will be found at TinkerFCU.org.

Will I need to make changes to my ACH and draft transactions?

Yes, please use ABA routing number 303085829 instead of 103103266, and the new 13-digit MICR account number found in your new online and mobile banking. If you need assistance, please contact us at 405-732-0324.

Will I be able to conduct my in-person business at any TFCU branch?

Yes. There are 32 TFCU branches across the state of Oklahoma and you’ll also have access to co-op shared branches across the country. For a full list of TFCU branches and co-op shared branch locations visit: TinkerFCU.org/locations

Will there be any changes to my account statements and notices?

Yes, you will start to receive separate statements for each of your TFCU accounts. They will look a little different than before, but will have all the information you need.

Do I need to order new checks?

You will be able to use your old checks. If you would like to order new checks, you can do so through your online and mobile banking, by calling the Member Service Center at 405-732-0324, or in person at any full-service TFCU branch.

Will the routing number change?

Yes, the routing number associated with your accounts will change to 303085829.

Do I need to adjust my direct deposit information?

No, you won’t need to make any changes to your direct deposit, these transactions will be processed just as they were prior to the update.

Will my transactional history carry over?

Yes, transactional history from the past two years will be available in the new platform.

Will I still be able to access my eStatements in online and mobile banking?

Yes, statements from the past seven years will be available in the new platform.